From Interest to Investment

IPO Club is a private investment platform designed for accredited investors who want access to late‑stage technology startups and secondary opportunities

Client

IPO-CLUB

Responsibilities

Idation, Wireframing, User Research, Design, Prototyping

Team

Manager, two Business Analysts, UX Researcher and Brand Market

Duration

Jun 2025 - Sep 2025

Impact From the Project

Developed and designed a customer onboarding workflow increasing new sign-ups by 150% within one week of rollout

Redesigned the company website and user experience, reducing bounce rate by 2%, and increasing unique visitors count by 839%

Leveraging stakeholder feedback& B2B investor materials, redesigned the pitch decks resulting in the acquisition of 5 new investors

Problem Statement

“How do we increase the website’s presence when sign‑ups were under 1%, visibility was low, trust signals were weak, and the user journey failed to convert?

Product Redesign

Persona

Demographics

Age Mid 50s

Location Coastal (SF, NY)

Financial Profile US Accredited investor, net worth >$1M

Pain Points

Unclear onboarding discourages signups

Investor decks lack narrative clarity

Requires trust in the fund’s history before moving forward

Goals

Diversify portfolio with late-stage tech and resilience sectors

Access trustworthy investment opportunities

Balance liquidity with long-term potential

Design Implications

Redesign for high-net-worth investors

Onboarding streamlined to cut friction and respect time

Refine pitch deck with clear visuals & story

Comparative Evaluation

Augment Market

Audience: Accredited investors ($10K min)

Strengths: Streamlined access to late-stage shares

Limitations: High fees, limited liquidity

IPO Opportunity: Lower entry barrier

OptoInvest

Audience: RIA, family offices

Strengths: Custom private market programs

Limitations: Advisor-centric, not consumer- facing

IPO Opportunity: Tailor for direct investors

EquityZen

Audience: Emerging retail investors

Strengths: Fast transactions, low minimums

Limitations: Early stage, limited brand recognition

IPO Opportunity: Balance accessibility pitch

Redesign and Revamping

Before

After

Footer

Redesigned the footer to improve usability and engagement by introducing modern icons, segmenting content, replacing the newsletter with a clear call‑to‑action button, and reinforcing the site’s branding through consistent visual language.

Company Page

Revamped the News & Articles section of the home page to improve readability and engagement by showcasing fewer articles with richer details and adding a clear button to view more.

News and Articles

Restructuring the company page prioritized readability by refining content layout, removing the search bar, and leveraging scroll features to simplify navigation for users.

Onboarding Experience

Inspiration

Speed as strategy

The entire flow is designed to be quick

Turn traffic into conversions by minimizing steps and decision fatigue

Single transaction clarity

By centering onboarding around one clear buy‑or‑sell action

Augment reduces complexity and gets users into meaningful engagement fast

Compliance without friction

Augment integrates the accredited investor check seamlessly

Regulatory requirements can be handled without derailing the user journey

Benchmark relevance

These qualities directly map to IPO Club’s challenge

Balancing compliance, clarity, and conversion

Onboarding

The parts that stood out to me were the progress bar, the top to bottom information flow with no side navigation, and the content was short and easy to read.

Rough Sketch

We utilized Figma to sketch how the outline could look, aiming to stand out by incorporating colors, using pill‑style selections, and designing the flow left‑to‑right.

Challenges

Rigid Data Tracking

Keywords in HubSpot were different from what we were used to when onboarding users.

Default branding

We could not incorporate IPO Club’s colors as much as we had planned in the platform, we had to rely on our website instead.

Design Limitations

HubSpot’s design was restrictive and leaned toward structured data workflows, which limited layout flexibility and customization.

Execution

These panels kick off onboarding with a clear progress bar and top‑to‑bottom layout. We adapted to HubSpot’s format while guiding users through identity and fund type selection. Brand colors were limited, but hierarchy and tone stayed consistent.

These panels capture experience and goals while integrating the accredited investor check. We adjusted for HubSpot’s rigid tracking terms and preserved clarity. The flow balances compliance with personalization to support conversions.

Capital Strategy

Challenge

Template Misalignment

Two business analysts built the initial pitch deck using a dark‑UI template inspired by 8VC’s investing platform, which emphasized flashy interactions and glowing effects.

The style clashed with IPO Club’s brand identity and diluted the professionalism of the presentation.

Visual Inconsistency

The analysts did not consult me on branding, typography, or color palette.

As a result, the slides were inconsistent in tone and design, weakening narrative cohesion and making the pitch feel fragmented.

Brand Alignment Elements

Typography

Arial simplifies readability for the target persona.

Consistency across all slides by standardizing hierarchy.

Reinforce a neutral tone aligned with IPO-CLUB identity.

Logo Refinment

Adjusted the logo by adding a white line for clarity across all slides.

Color Palette

Deep Navy (#101925)

Green (#11684C)

Light Neutral (#E1DFD7)

Blue Accent (569ED8)

Black (#000000)

Clarifying the Capital Narrative

Before

After

Fund I - Exits

Reformatted the original content to ensure presentation clarity. The initial version included warped characters and overlapping text, which compromised readability and visual hierarchy. The layout and typography skimmable and investor‑ready.

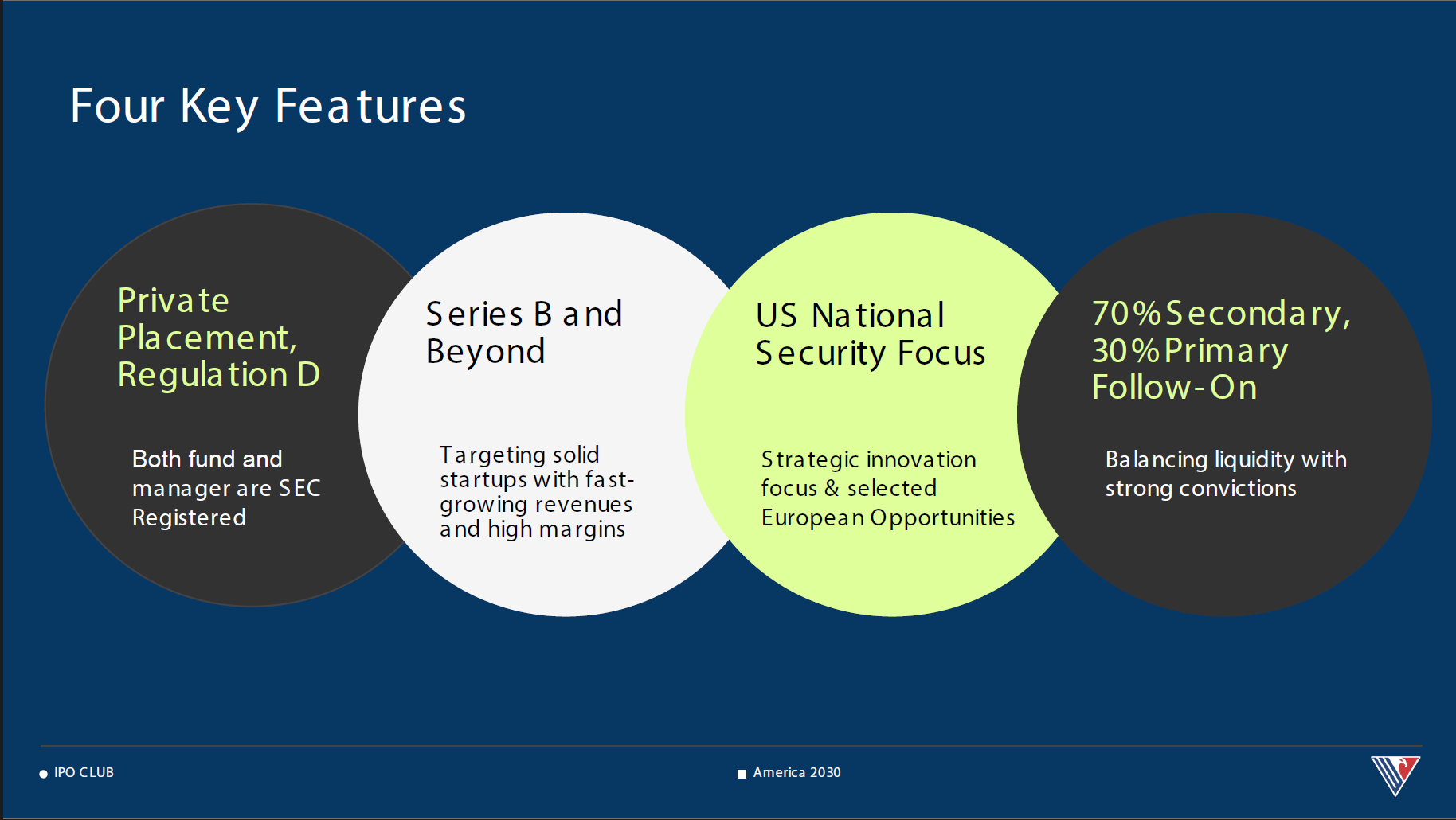

Fund II - Four Key Features

Apply the exact color palette and typography from IPO Club’s website to ensure brand consistency. This slide reflects the company’s established identity, reinforcing cohesion between the online presence and investor presentation.

Reflection

Solo User Experience Researcher

Designed a product solo for the first time, a role that deepened my understanding of product management.

What We Missed

Despite strong results, we did not have the opportunity to produce videos that explained the platform, an area I was excited to explore.

Interest in Venture Capital

My interest in venture capital reflects how investing can drive innovation and empower entrepreneurs.

Business Analytics

The role became the catalyst for my dual degree pursuit, the stakeholder collaboration added energy and fun to the process.